Intimacy with God has the power to transform lives, and living generously is one way we can partner with Him. When you surrender to God by living generously, it changes lives.

Imagine what could happen when we partner together to help people around the world seek God every day!

“Once I had the Bible App, it was easier to stay focused. Now I come to God every day, read every day, pray every day.”

“The Verse of the Day seems like it is made for me—it’s as if God is speaking directly to me.”

“The Bible App has enlivened, personalized and intensified my relationship with God and this is because of building a daily routine of Bible reading.”

“I was a junky, dead beat father, divorced three times, porn addict, sex addict. Having the Bible App allowed God to work in my life. Now, I’m truly seeking after Him!”

“I read Plans with my parents who live in Chile, and we talk about Jesus every day, and I learned how to pray and how to actually read the Scriptures.”

“Using the Bible App, I can have continuity in reading the Bible wherever I go as every translation is available. I can easily access God and His Word, increasing my faith.”

One Seed Can Change the World.

God’s Word is the seed that has the power to transform lives. Every time someone downloads a Bible, a seed is planted. And every time that person opens their Bible, that seed is watered.

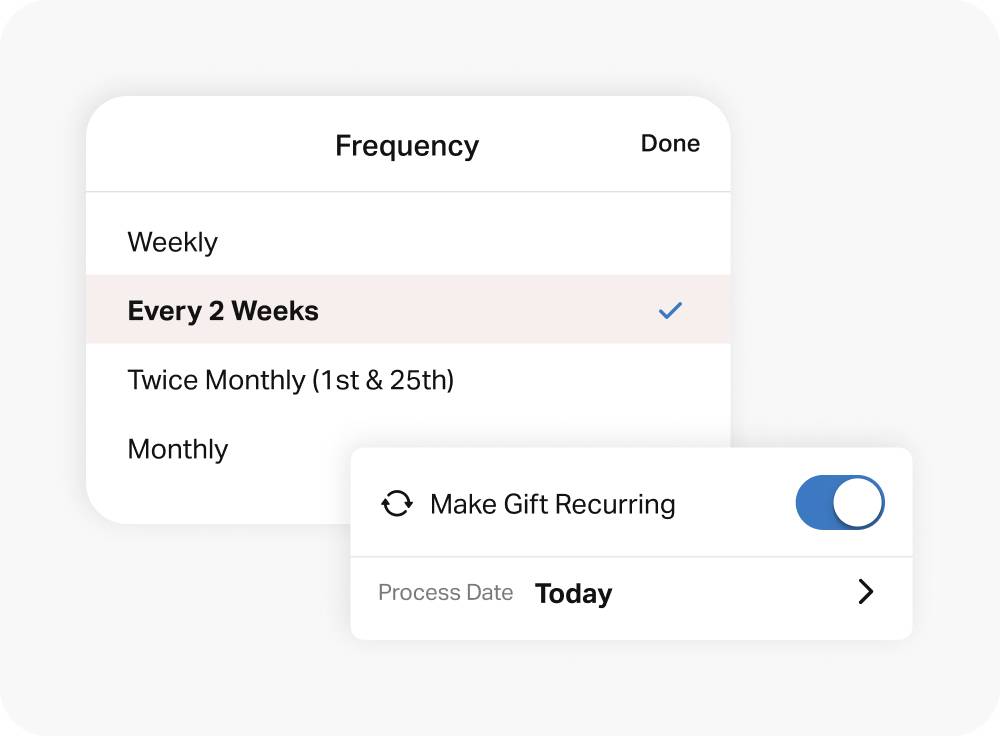

Join our growing community of Sowers by making a monthly recurring commitment to reach everyone, everywhere with God’s Word.

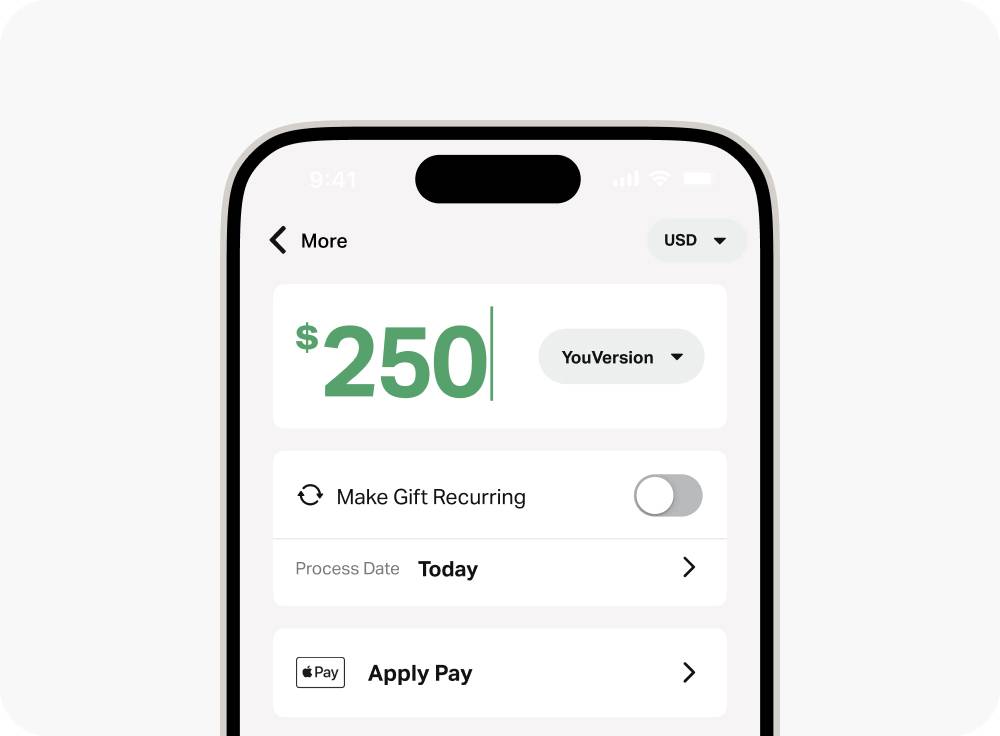

Give to YouVersion

Has YouVersion helped you draw near to God? When you support YouVersion, you get to help others experience God’s generous love as you draw closer to Him through generosity.

Give to Bible Translation

What will happen when everyone, everywhere, has access to God’s Word in their heart language? Let’s find out. Help us get the Bible translated into every language by the year 2033.

Unleash your generosity by donating stocks.

Donating stock can be one of the most tax-efficient ways to give. We've partnered with Overflow to make donating stock online quick, easy, and secure.

Give StockFAQs

Who is Overflow?

Overflow is a digital solution for donating non-cash assets, helping you give in a tax-efficient way. Right from your mobile device, you’ll experience the ease of giving via stock or crypto in less than five minutes. Overflow also provides you with access to a private Donor Portal that provides visibility into your transaction history, transaction statuses, and the ability to update connected financial accounts.

Is giving through Overflow safe and secure?

Overflow's Information Security Program is SOC 2 compliant, a widely respected information security auditing procedure. Overflow does not have access to or store any brokerage account usernames or passwords. They use Yodlee, a third-party provider, that handles the brokerage log-in process. Over 600 companies including, PayPal, Mint, and Amazon, use Yodlee to connect their clients’ accounts.

Can I give through my 401K or IRA?

Overflow can process all whole shares of publicly traded stock, including 401Ks and IRAs. However, because donors often incur penalties for withdrawing these assets before a certain date, we highly recommend consulting your tax professional before donating these types of assets. Donating 401Ks or IRA could result in major tax penalties or even fewer tax benefits than donating cash.

Does Overflow support gifts from my brokerage account?

Overflow currently supports more than 10 brokerages via their self-guided platform, including the most popular brokers such as Charles Schwab, Fidelity, and E*Trade. If Overflow doesn't have a direct connection to your brokerage account, your gift can still be fulfilled through their off-platform concierge service. If you are in Overflow's donor experience and your brokerage account is not one of the 10+ currently supported with a direct connection, you'll be taken to a form to contact Overflow's transaction operations team. Email stockgifts@overflow.co to choose to opt into Overflow's fully-guided concierge service.

What is the tax benefit of donating appreciated stock?

Donating appreciated stock that you've held for over a year could allow you to save up to 20% in capital gains taxes and potentially up to 37% in federal income taxes on the charitable donation value of your gift based on your tax bracket when itemizing deductions. To understand the full tax benefits of giving appreciated stock, including potential state tax savings, please consult with your tax professional for information about your personal tax implications.

Can I give company stock outside of the trading window?

If you received company-distributed stock as an employee and the trading window is not open, your brokerage will likely reject the transfer request. We highly advise you ask your company for the trading windows so you can give during those time periods, which are typically open quarterly for three to four weeks at a time.

What specific stock could I donate?

You can give any publicly traded stock through Overflow. By donating assets that have appreciated in value for more than one year, you are more likely to maximize the potential tax benefits of your gift.

YouVersion is not a business; we have never had plans to monetize our app, nor to sell data or ads, nor will we. Everything we make is available for free because we don’t want anything to inhibit people from drawing closer to God. Our ministry is supported financially by Life.Church and by the generosity of our worldwide YouVersion Community.

Don’t forget to check with your tax advisor about any tax implications for your situation.